How Do You Automate Accounting Without Manual Journal Entries and Month-End Chaos?

Complete accounting automation from transaction to financial statements. Automate journal entries when orders ship and invoices are paid, eliminate manual bank reconciliation, generate financial statements instantly, track accounts payable and receivable automatically, and sync accounting with inventory, sales, and purchasing in one system that eliminates double-entry bookkeeping and month-end closing delays.

Most businesses manage accounting using spreadsheets for journal entries, manual bank reconciliation, disconnected accounts payable and receivable tracking, and time-consuming month-end closing processes. Transactions require duplicate data entry between operational systems and accounting software, nothing syncs automatically, and financial statements are outdated by the time they're completed. Alpide Accounting Automation posts journal entries automatically when transactions occur. Sales orders create revenue and accounts receivable entries, purchase invoices create expense and accounts payable entries, inventory movements update cost of goods sold, and bank transactions reconcile automatically—eliminating manual bookkeeping, reducing month-end closing from weeks to hours, and providing real-time financial visibility instead of outdated monthly reports.

Complete Automated Accounting System

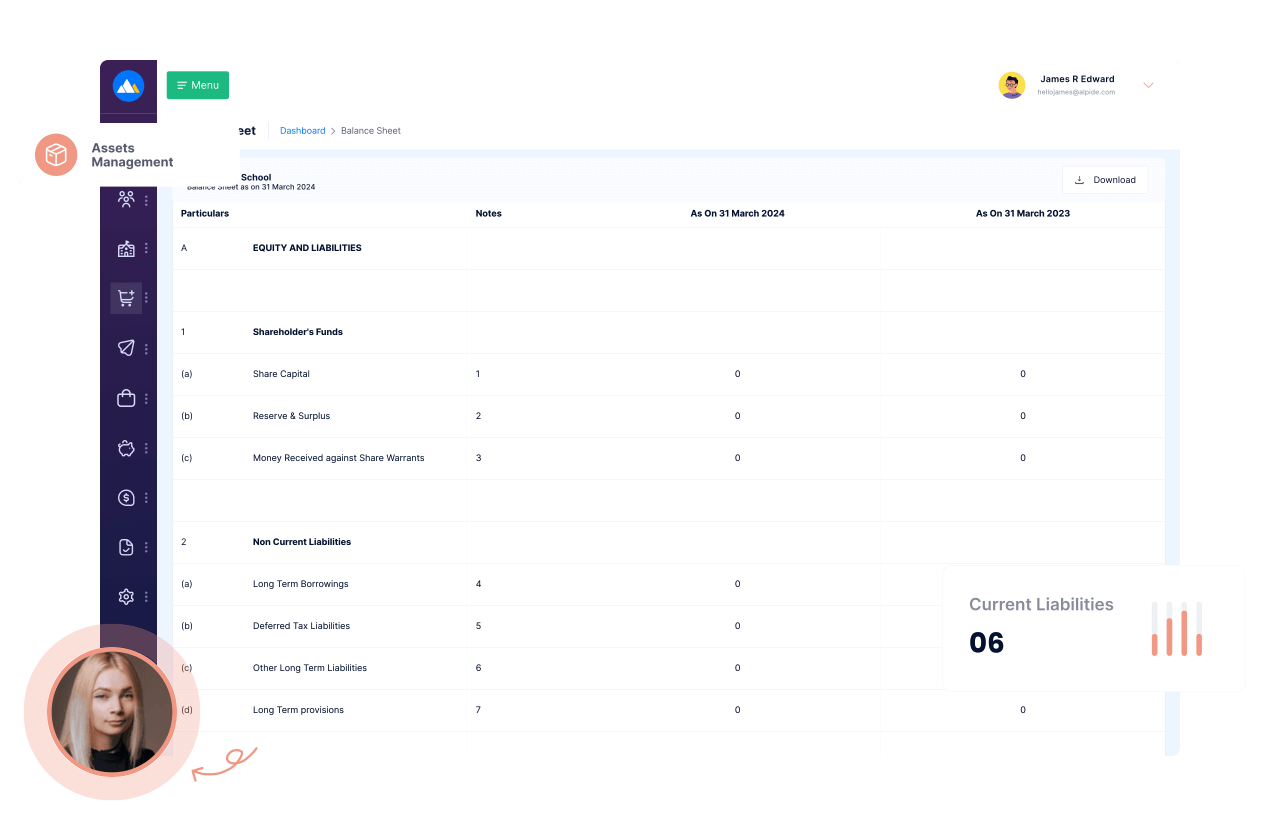

Automate the complete accounting cycle from transaction recording through financial statement generation. Journal entries post automatically from sales orders, purchase invoices, inventory movements, and payroll transactions. Accounts payable and receivable track automatically without manual entry. Bank reconciliation matches transactions automatically. Multi-currency accounting handles foreign exchange automatically. Financial statements including balance sheet, income statement, and cash flow statement generate instantly with current data. Real-time financial visibility replaces outdated monthly reports and eliminates manual double-entry bookkeeping.

Centralized Financial Data

View complete financial information from one dashboard including profit and loss, balance sheet, cash flow, accounts payable aging, accounts receivable aging, and tax liabilities. All financial data updates in real-time as transactions occur. Drill down from financial statements to underlying transactions for detailed analysis. Centralized accounting eliminates searching through multiple systems for financial information and ensures everyone sees the same current data.

Cloud-Based Access

Access financial data from anywhere using web browser. Accounting team reviews transactions remotely, executives view financial dashboards while traveling, auditors access records without visiting office. Multi-user access with role-based permissions ensures appropriate access levels. Cloud-based accounting eliminates local server maintenance and enables work-from-anywhere flexibility.

Automated Transaction Processing

Journal entries post automatically when business transactions occur—sales create revenue entries, purchases create expense entries, inventory movements update cost of goods sold, payroll creates expense entries, and bank transactions post automatically when reconciled. Eliminates manual double-entry bookkeeping, reduces accounting errors, and provides real-time financial accuracy without manual data entry.

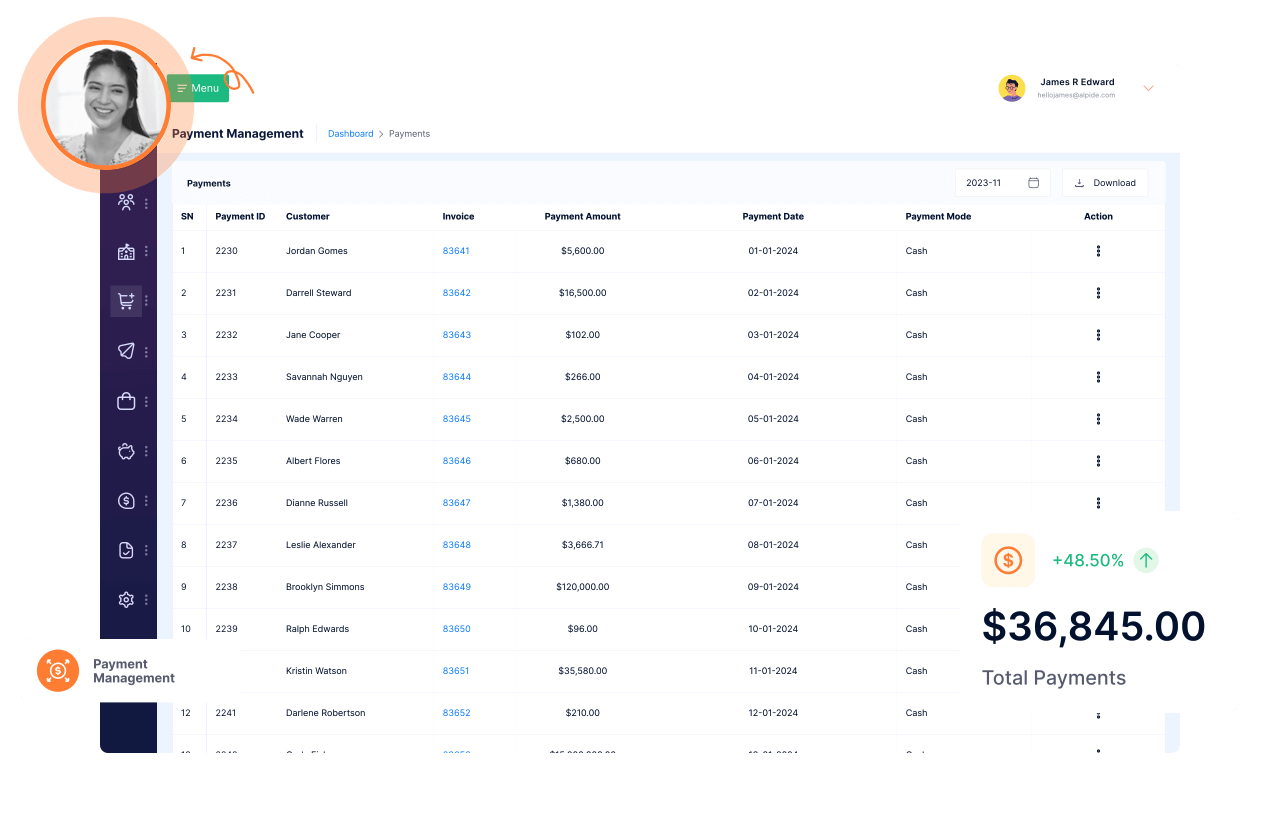

Automated Accounts Payable & Receivable

Automate accounts payable by matching vendor invoices to purchase orders, routing invoices for approval, scheduling payments, and posting journal entries automatically. Automate accounts receivable by generating customer invoices from sales orders, tracking payment due dates, sending payment reminders, and applying payments automatically when received.

Multi-Currency Accounting

Handle transactions in multiple currencies with automatic exchange rate updates. System calculates gains and losses from currency fluctuations automatically. Financial statements consolidate multi-currency transactions into reporting currency. Multi-currency support enables international business without manual currency conversion calculations.

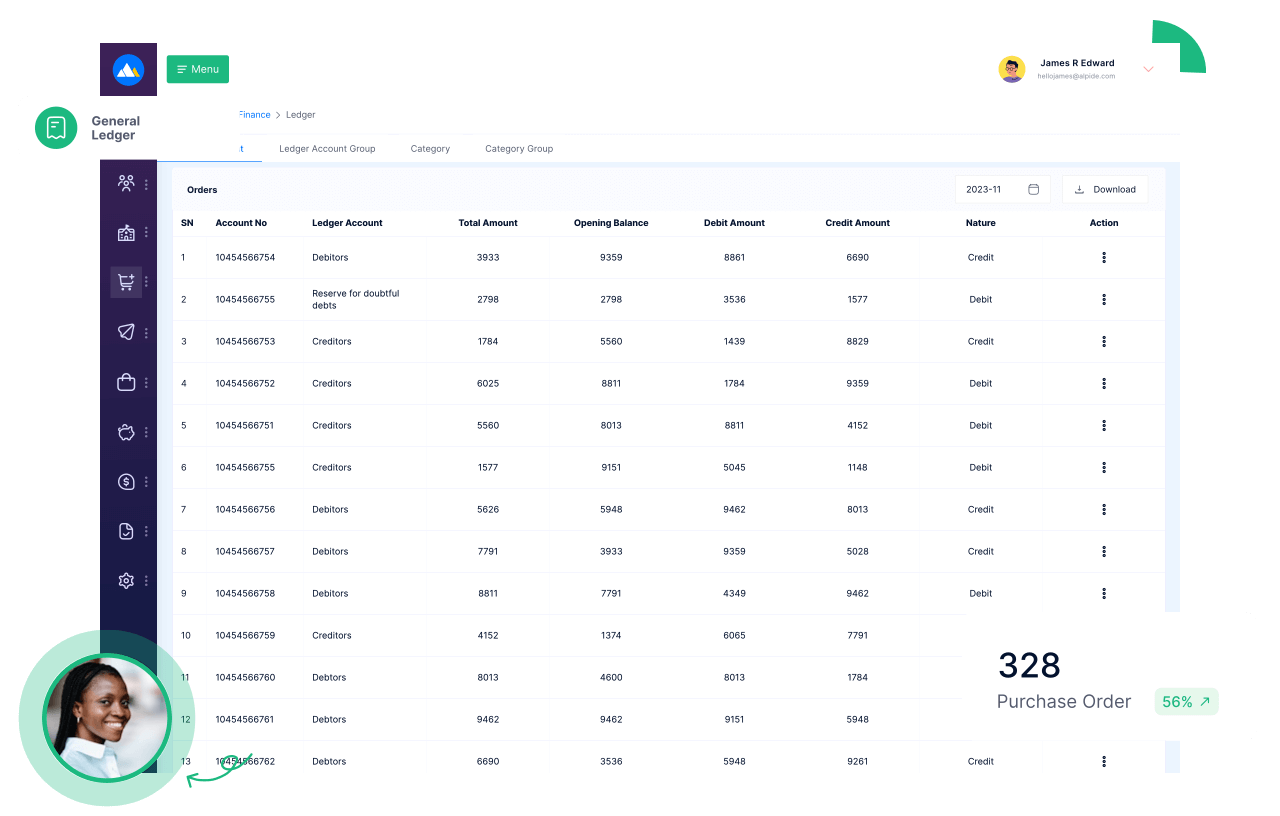

Automated General Ledger

Journal entries post automatically from sales orders, purchase invoices, inventory movements, payroll, and bank transactions. Chart of accounts organizes all financial transactions. Trial balance, balance sheet, and income statement generate automatically from general ledger. Automated posting eliminates manual journal entry errors and provides real-time financial accuracy.

Financial Analysis

Generate financial reports including profit and loss by department, balance sheet with comparisons, cash flow statements, budget versus actual analysis, and multi-entity consolidation. Schedule automated report delivery to stakeholders. Export financial data for tax preparation and external audits.

Maintain regulatory compliance

Following local and international regulations, auditing trail documentation for regulatory submission; and keeping a track of financial performance against industry standards.

Enhancing financial performance

Track financial performance trends over time with comparative reports. Identify revenue and expense variances from budget. Monitor key financial ratios including gross margin, current ratio, and debt-to-equity. Real-time financial visibility enables proactive decisions instead of reacting to outdated monthly reports.

Set up custom financial period closing

Configure financial periods including monthly, quarterly, and annual closings. Lock closed periods to prevent changes. System guides period-end closing process with checklist. Automated journal entries and reconciliations reduce month-end closing time from weeks to days.

Asset Management

Track fixed assets including equipment, vehicles, buildings, and furniture from acquisition through disposal. Calculate depreciation automatically using straight-line, declining balance, or custom methods. Generate depreciation schedules and post depreciation entries automatically. Maintain asset history for insurance and audits.

Manage, report and monitor fixed assets

Generate and keep a track of the fixed asset investment. It will enable accuracy and efficiency.

Automate Asset Reconciliation

Keep a close track of the balance to ensure seamlessness of the asset.

Define Asset Depreciation

Schedule, calculate and record depreciation for a smooth process

Track, Record and Monitor Assets Disposals

Monitor, track and record the use and activities of the assets in compliance with the laws and regulations.

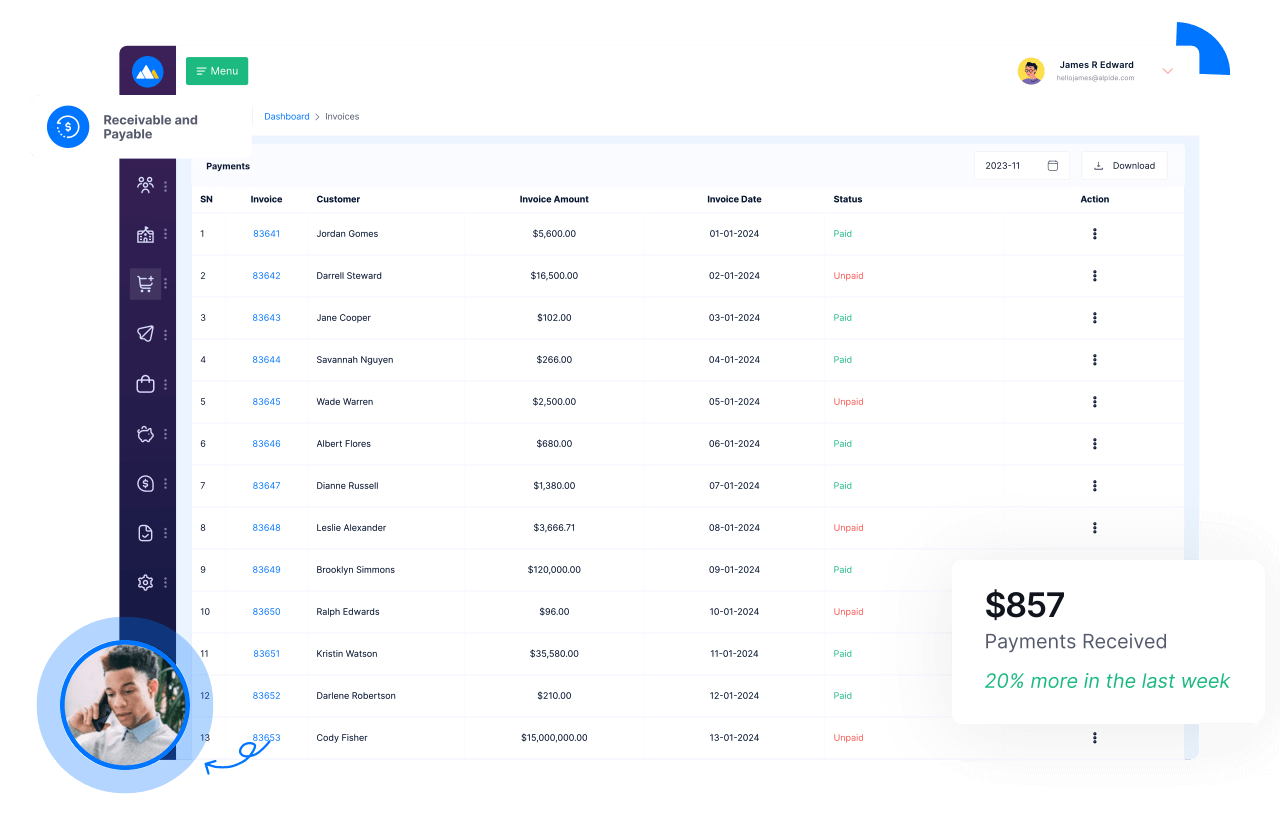

Account Receivable

Generate customer invoices automatically from sales orders. Track payment due dates and send automated payment reminders. Apply customer payments automatically against outstanding invoices. Monitor accounts receivable aging to identify overdue accounts. Credit limit controls prevent sales to customers exceeding credit limits.

Setup, process and monitor payments

Create customer accounts and payment terms. Receive and keep a track of the accounts.

General Reports

Create summaries of the accounts receivable data.

Manage Cash Flow

Manage and keep tabs on outstanding customer payments and credit limits

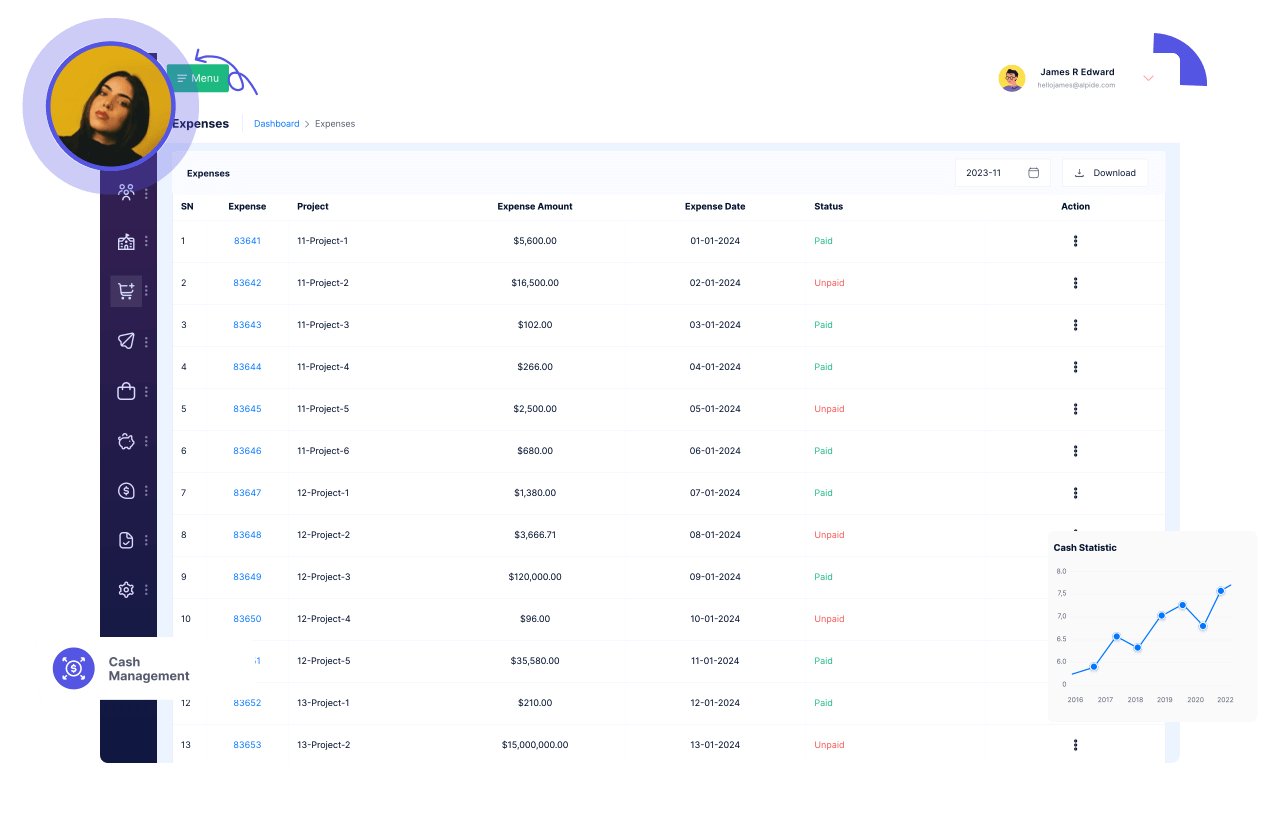

Accounts Payable

Match vendor invoices to purchase orders automatically with three-way matching including purchase order, goods receipt, and invoice. Route invoices through approval workflows. Schedule vendor payments based on payment terms and cash flow. Track accounts payable aging by vendor. Prevent duplicate payments and overbilling.

Streamlining cash flow and vendor relations

Account payable services help optimize your business's cash flow, ensuring efficient use of resources. They also foster strong vendor relations by enabling timely and accurate payments, enhancing trust and collaboration.

Tracking expenses

Accounts payable makes monitoring every financial transaction effortless. This capability ensures a clear and detailed financial record, essential for understanding and managing business's spending.

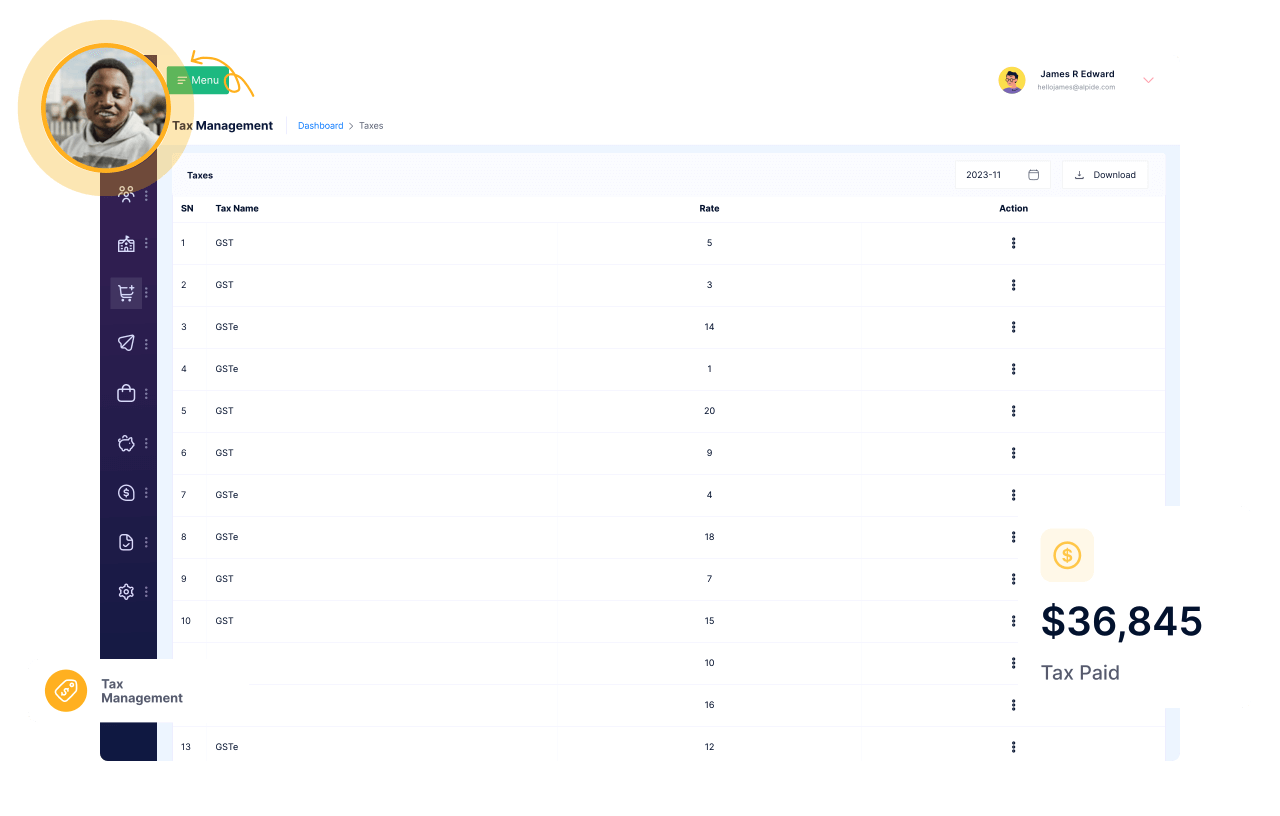

Setting up tax rules

Implementing tax rules efficiently is streamlined with tax receivable and payable. It ensures the business adheres to tax regulations, avoiding complications and maintaining fiscal health.

General Ledger

Central repository for all financial transactions with complete audit trail. Chart of accounts organizes revenue, expenses, assets, liabilities, and equity. Journal entries post automatically from all business transactions. Trial balance verifies debits equal credits. Financial statements generate automatically from general ledger balances.

Automate Journal Entries

It streamlines the process, automatically recording transactions, ensuring accuracy and saving valuable time.

Reconcile Accounts

It simplifies the process of matching your ledger with bank statements or other financial records, ensuring your accounts are always accurate and up-to-date.

Monitor and Analyze Accounts

It allows you to keep a close eye on financial health, identifying trends and areas for improvement, guiding smarter business strategies.

Why Unified Accounting Beats Standalone Accounting Software

Traditional businesses use standalone accounting software like QuickBooks or Xero that requires manual data entry from operational systems. Every sale needs manual invoice entry into accounting, every purchase requires duplicate entry, inventory movements need manual journal entries, and nothing syncs automatically without expensive integration tools. Month-end closing requires reconciling accounting with operational systems, and financial statements are outdated immediately because they don't reflect real-time operations. Alpide Accounting connects directly with order management, inventory, purchasing, manufacturing, and payroll in one unified platform. When sales orders ship, revenue and accounts receivable journal entries post automatically. When inventory is received, cost entries post without manual input. When payroll runs, expense entries post instantly. You eliminate duplicate accounting data entry from operational systems, stop reconciling accounting with operations at month-end, and end the frustration of outdated financial statements. One system where accounting flows automatically from every business transaction.

Common Accounting Scenarios Where Alpide Helps

Real-world challenges solved with unified accounting automation platform.

Closing books at month-end without working nights and weekends

Automated journal entries eliminate manual transaction entry during month-end closing. Bank reconciliation matches transactions automatically instead of manual reconciliation. Inventory valuation calculates automatically. Depreciation posts automatically. Accruals and deferrals post based on rules. Month-end closing checklist guides process systematically. What previously required two weeks of intensive work now completes in two days with automated accounting.

Matching vendor invoices to purchase orders to prevent duplicate payments

Three-way matching compares purchase order, goods receipt note, and vendor invoice automatically. System flags invoices that don't match approved purchase orders or confirmed receipts. Duplicate invoice detection prevents paying the same invoice twice. Approval workflows ensure proper authorization before payment. Only invoices matching approved POs and confirmed receipts proceed to payment queue.

Tracking accounts receivable aging and collecting overdue payments

Accounts receivable aging report categorizes outstanding invoices by 30/60/90/120+ days overdue. System sends automated payment reminder emails at specified intervals before and after due dates. Customer statements show all outstanding invoices and payment history. Collection reports identify customers with chronic late payments. Real-time aging visibility enables proactive collections instead of discovering problems months later.

Reconciling bank accounts without hours of manual matching

Bank transactions import automatically from bank feeds or uploaded files. System matches bank transactions to accounting entries automatically based on amounts, dates, and descriptions. Unmatched items flag for manual review. Reconciliation reports show matched transactions, outstanding checks, and deposits in transit. What previously required hours of manual matching now completes in minutes with automated bank reconciliation.

Generating accurate financial statements for investors or lenders

Balance sheet, income statement, and cash flow statement generate instantly with current data from general ledger. Comparative reports show current period versus prior periods. Multi-entity consolidation combines financials from multiple companies. Export to Excel for custom formatting. Schedule automated monthly report delivery to board members. Real-time financial statements replace outdated reports prepared weeks after period end.

Frequently Asked Questions

Can we set up approval workflows for vendor invoice payment?

Yes. Configure approval hierarchies based on invoice amount, vendor, or department. Small invoices auto-approve, medium invoices require manager approval, large invoices require executive approval. Invoices route to appropriate approvers automatically. Approvers receive email notifications with invoice details and can approve or reject with one click. Complete audit trail tracks all approval decisions. Approval workflows prevent unauthorized payments and ensure proper oversight.

How does three-way matching prevent paying for goods we didn't receive?

System compares purchase order, goods receipt note, and vendor invoice before payment approval. Flags invoices for quantities exceeding what was received, prices different from purchase order, or invoices without corresponding purchase orders. Only invoices matching approved POs and confirmed receipts proceed to payment. Three-way matching prevents paying for undelivered goods, duplicate invoices, and overbilling from vendors ensuring payment accuracy.

Can we track accounts payable and receivable aging in real-time?

Yes. Accounts payable aging report categorizes vendor invoices by current, 30, 60, 90+ days since invoice date. Accounts receivable aging categorizes customer invoices by days past due. Real-time aging updates as new invoices are created and payments are received. Identify vendors requiring immediate payment and customers with overdue invoices. Aging reports enable proactive payment and collection management instead of reacting to problems discovered during monthly reviews.

How does automated bank reconciliation work?

Bank transactions import from uploaded statement files. System matches bank transactions to general ledger entries automatically based on amounts, dates, check numbers, and descriptions. Matched transactions mark as reconciled. Unmatched items flag for manual review and entry. Reconciliation report shows matched transactions, outstanding checks, and deposits in transit. Automated matching reduces bank reconciliation from hours to minutes monthly.

Can we generate financial statements for multiple companies or locations?

Yes. Maintain separate chart of accounts for each company or location. Generate individual financial statements per entity. Multi-entity consolidation combines financials from all entities into consolidated statements. Intercompany transaction elimination ensures accurate consolidated reporting. Comparative reports show performance across entities. Multi-entity accounting supports businesses with multiple subsidiaries, franchises, or geographic locations requiring separate and consolidated financial reporting.

How do we handle multi-currency transactions and foreign exchange?

Record transactions in original currency with automatic conversion to reporting currency. System updates exchange rates automatically or manually. Calculates unrealized gains and losses from outstanding foreign currency receivables and payables. Realized gains and losses post when foreign currency transactions settle. Multi-currency financial statements show amounts in reporting currency. Multi-currency accounting eliminates manual currency conversion calculations and ensures accurate foreign exchange accounting.

What accounting reports help with tax preparation and audits?

Generate general ledger reports, trial balance, chart of accounts, journal entry reports, transaction detail reports by account, vendor and customer transaction reports, fixed asset schedules, and tax reports including sales tax collected and paid. Export data to Excel for accountants and auditors. Schedule automated monthly report delivery. Complete audit trail shows who entered or modified every transaction. Comprehensive reporting simplifies tax preparation and external audits.

How does the system handle fixed asset depreciation?

Track fixed assets including purchase date, cost, useful life, and depreciation method. Calculate depreciation automatically using straight-line, declining balance, sum-of-years-digits, or custom methods. Generate depreciation schedules showing monthly and annual depreciation expense. Post depreciation journal entries automatically each period. Fixed asset tracking ensures accurate balance sheet presentation and tax depreciation calculations.

How is Alpide Accounting different from standalone accounting software like QuickBooks or Xero?

QuickBooks and Xero are powerful accounting platforms but require manual data entry from operational systems or expensive integration tools. Alpide Accounting integrates natively with order management, inventory, purchasing, manufacturing, and warehouse operations in one unified platform. For growing businesses needing accounting plus complete operations management, Alpide eliminates duplicate data entry between systems, provides real-time financial visibility, and costs substantially less than buying accounting software plus integration tools.

Related Questions About Accounting Automation Software

Do we need an accountant if accounting is automated?

Yes, but for higher-value work. Accountants shift from manual data entry and reconciliation to financial analysis, tax planning, and strategic advice. Automation handles routine transaction recording and report generation. Accountants focus on interpreting financial data, identifying opportunities, and providing guidance. Automation makes accountants more valuable by freeing them from manual bookkeeping tasks.

How long does month-end closing take with automated accounting?

Substantially faster than manual closing. Automated journal entries eliminate days of transaction entry. Automated bank reconciliation completes in minutes instead of hours. Automated depreciation posts instantly. Typical month-end closing reduces from 10-15 days with manual accounting to 2-3 days with automation. Some companies achieve same-day closing with full automation and proper preparation.

Can automated accounting integrate with our existing payroll or tax software?

Alpide includes integrated payroll eliminating need for separate payroll software. For businesses committed to existing systems, work with Alpide team to discuss integration options. Integrated accounting, operations, and payroll in one system eliminates reconciliation between systems and ensures real-time financial accuracy versus connecting separate systems through integrations.

What's the ROI of implementing accounting automation?

Typical ROI includes reduced accounting staff time from eliminating manual entry, faster month-end closing reducing overtime costs, reduced accounting errors from automation, improved cash flow from real-time visibility, and better decisions from current financial data. Most organizations achieve payback within 4-8 months from labor savings and efficiency gains alone, not counting improved decision-making benefits.

Alpide blog

Boost Your Business with Alpide! Expert insights on ERP, E-Commerce, CRM, Warehouse, Accounting, HR, Sales, Finance & more to fuel your growth.

Talk to Expert

Transform Your Business With Alpide

Streamline your business operations, access real-time insights, enhance control, ensure data accuracy, lower expenses, fulfill orders efficiently, and elevate customer service with.

Contact Us